In the movie “The Patriot” Benjamin Martin tells his sons “Aim small, miss small.” I have found this advice very apropos to analytics. With all the excitement surrounding the use of mobile device location data, I thought I would devote this blog to aiming small.

About the Strategic Alliance and the Trade Areas

The Directory of Major Malls provided the mall/shopping center data. B. I. Spatial geofenced all the US locations. UberMedia (UberRetail) supplied all the mobile location data for the mobile devices observed within the geofences. B. I. Spatial scrubbed the raw mobile device location data (billions and billions of GPS-accurate points) and assigned the most likely home location for each mobile device. Using the likely home locations, B. I. Spatial applied its proprietary trade area methodology to delineate the trade areas. Our process is incredibly complex, but in a nutshell, we use multiple, goal seeking iterative macros within Alteryx to produce the best trade area.

Reader Beware!

- B. I. Spatial is in business, so the rest of the blog is my attempt to both educate and sell you on the use of GPS-based mobile location data only. I will say that we only sell what we believe in. After working extensively with this data for nearly two years, here are the main points of the blog:

- GPS-based mobile device location data is the only mobile source that allows for the precision required by today’s best location analysts.

- Cell tower-based location data is not accurate enough for many of the purposes for which it is being touted.

- Neighborhood (Zip Code or Block Group) appending is not that useful by itself. Just step outside your front door and look at your neighbors. If you find that you are different from them, imagine the difference between you and the rest of your Zip Code or Block Group population.

If you are still reading – thanks for sticking with me.

Prior to the Press Release

UberRetail and B. I. Spatial began offering previews of our upcoming mall trade areas at the ICSC Research Connections held last October in January. Both the process and the trade areas were met with great excitement. However, there was one naysayer in the group. Our detractor agreed that the mobile device location data is the best source for this type of analysis, but, disagreed with our trade area representation.

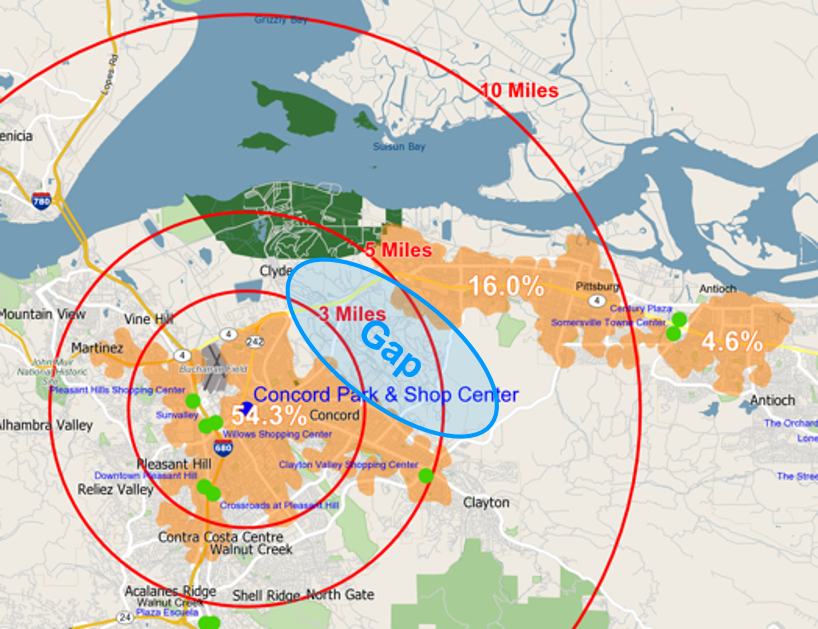

The “gap” in trade area coverage was the sticking point. “Look at all the streets,” “you can’t leave that out” and “our customers will never accept these” were some of the comments.

For the record, many of the streets in the “gap” are actually within the Port Chicago Naval Magazine, a Naval Weapons Station (37.987799, -121.981532). It is important to remember that our trade areas are based on concentrations mobile-based residential points. Had we tried to include the munitions dump in the trade area our credibility might have, sorry, been blown apart.

Regarding the comment that customers would never accept these disjointed trade areas was incorrect. The comments we have heard are more along the lines of “those make perfect sense” or “that explains it”. Either the detractor was wrong, or, we simply have smarter customers.

Since the Press Release

Apparently we have stumbled on to something. We have customers asking for, and receiving, competitors’ trade areas. Others, who don’t have loyalty programs, are using our approach to better understand their customers and plan their next locations.

Based on clients and prospects’ questions and comments, we are developing additional products which give even greater insight to who the customers are – not just where they are.

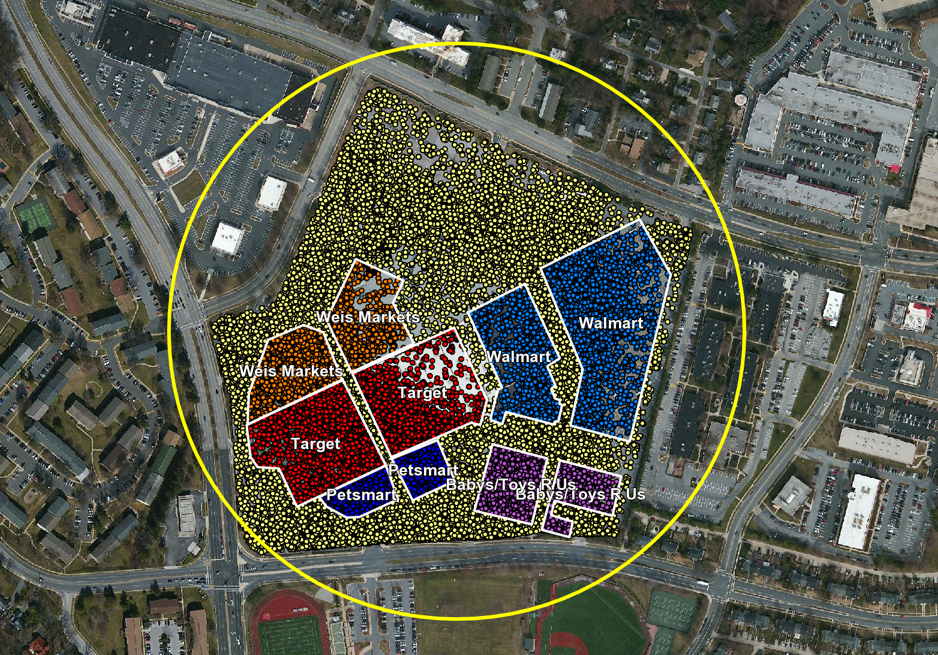

Take a look at the image below. This image depicts our ability to differentiate customers by the store they shopped, where they parked, and, using their likely home locations, append household level attributes such as Experian’s Mosaic Segmentation codes. The result is that we can develop Mosaic profiles and trade areas for individual anchors and compare them to the center as a whole.

As a point of comparison, the yellow ring is a 300 meter radius, the published average accuracy of cell tower data. Customer differentiation is impossible without GPS.

Cell tower imprecision also detracts from understanding home locations. I believe the reason cell tower-based solutions talk about grid cells and neighborhoods is because that’s all they can do. If you care about block groups and zip codes, cell tower based solutions may be okay to use. But, as a professor friend of mine asked, “How many block groups actually shop inside your stores?” If you want to know about the customer, our solution is better.

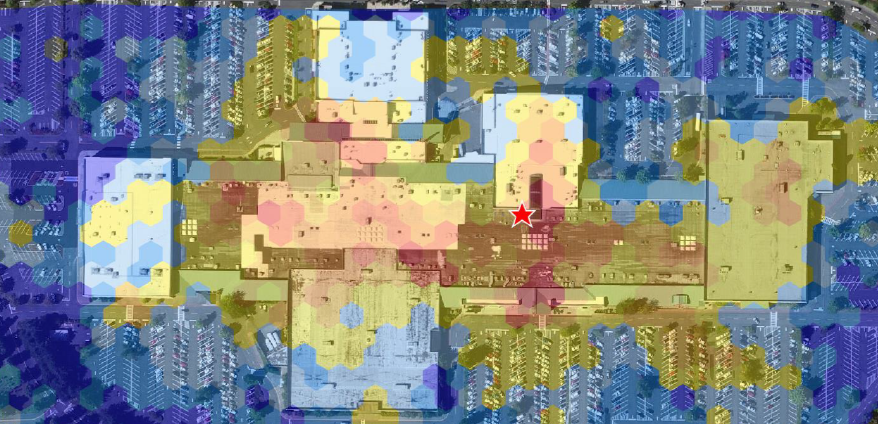

Another requested product was heat maps of enclosed malls. Smaller mall-based retailers want to know where in the mall they should be. Overlaying mobile device location data allows for a quick read on mall activity.

Conclusion: GPS-based mobile device location data is a game changer

It is that simple. If you are interested in hearing more, talking about methodologies and use cases, give us a call. Or, let’s talk at one of the upcoming conferences.

I will be presenting at the 2016 PopStats Research Conference, April 4-6 in Austin, TX. In my presentation I will demonstrate how the Mobile Location Data-based trade areas, coupled with PopStats demographics, fit easily into Tableau – allowing easy dissemination of consumer and market-based insight.

I will also be presenting at the 2016 Store Location Conference, May 4-6 in Clearwater Beach, FL. I will offer mobile device location case studies within the grocery industry and will focus on using the mobile data to help the store location analysts calibrate the gravity models.

I will also be attending Alteryx Inspire, June 6-9 in San Diego, CA. I’ll likely be hanging out in the Solutions Center.

If you attend any of these conference please reach out. My phone is 336-209-4321 and my email address is [email protected].

Thanks again for taking the time to read this.

Great artlcie, thank you again for writing.